Why invest in Helios?

Helios offers access to insurance and reinsurance exposures, providing a growth and income opportunity.

Why invest in Helios?

Market conditions

The strategy is to take advantage of the excellent underwriting conditions.

First move advantage

No competition; high barriers to entry.

Expertise

A management team deeply experienced and networked in Lloyd’s.

Uncorrelated to equity market movements

Exposure to Lloyd’s, the world’s prime insurance market.

Success to date

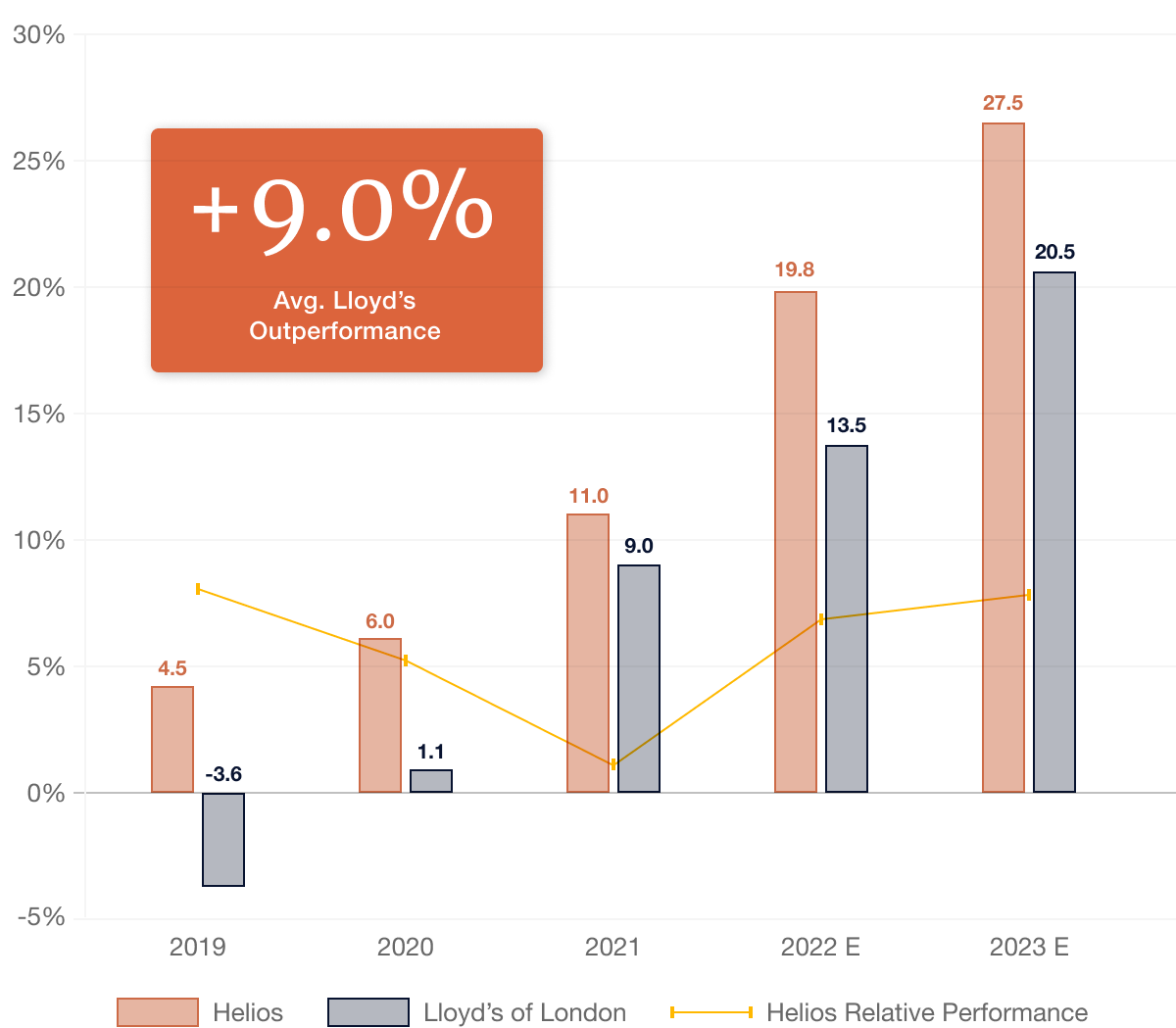

Has outperformed Lloyd’s by 9% over the last five years.

Improved prospects for underwriting profitability.

Rate increases since June 2017 in aggregate in excess of 50%.

Profitability has materialised

Return on Capital Helios vs Lloyd’s Market Performance

Outperformance driven by:

- Selection of best performing syndicates

- Portfolio optimisation, maximising diversification and business mix

- Diversification reduces underwriting capital requirements

Inheritance tax

Helios Underwriting Plc has been advised that its ordinary shares are eligible for Business Relief (formerly known as Business Property Relief) for Inheritance Tax purposes. The exemption is applicable for shareholdings in unquoted trading companies. For these purposes, AIM listed shares are considered to be unquoted. This is not intended to be tax advice. Individual investors should seek their own personal tax advice prior to making decisions to trade in Helios Underwriting Plc’s share capital.